Operational performance

2022 was a new record year for PhosAgro in terms of output and sales. Compared to 2021, agrochemical output increased by 4.6% to 11.1 mt, while shipments to customers expanded by 6.8% to 11 mt.

In our key segment of phosphate-based fertilizers, we demonstrated annual production growth of above 4% for the third year running. The market environment caused us to make serious changes to our product mix. In our key DAP/MAP grades and NPS, we improved the 2021 performance by 16.1% and 78.6% respectively, while NPK and APP output was down by 17.9% and 45.3% respectively. This production flexibility is the result of a number of successful investment projects, including MAP production at the Volkhov site reaching its full capacity.

In 2022, nitrogen-based fertilizer output grew by 5.6%

y-o-y , outpacing production ofphosphate-based fertilizers. The granulated ammonium sulphate segment demonstrated the most impressive growth of more than two times thanks to expanded capacities to produce this very popular product. Production of urea, the nitrogen segment's core product, went up by 2.7% to 1.7 mt.In 2022, we allocated a record RUB 63 bln (including capitalised repairs) to upgrading and expanding our production capacities. In 2023, these investments will hit RUB 67 bln.

Safety at our production sites remains our absolute priority. We reduced LTIFR from 0.81 in 2021 to 0.38 in the reporting year, with the Cherepovets site team delivering the best LTIFR of 0.12, more than three times lower than the Company's overall result.

Alexander Gilgenberg, General Director of Apatit

PhosAgro is the largest producer of liquid nitrogen-phosphorus fertilizers in Russia

OUR CUSTOMERS

are at the heart of our business

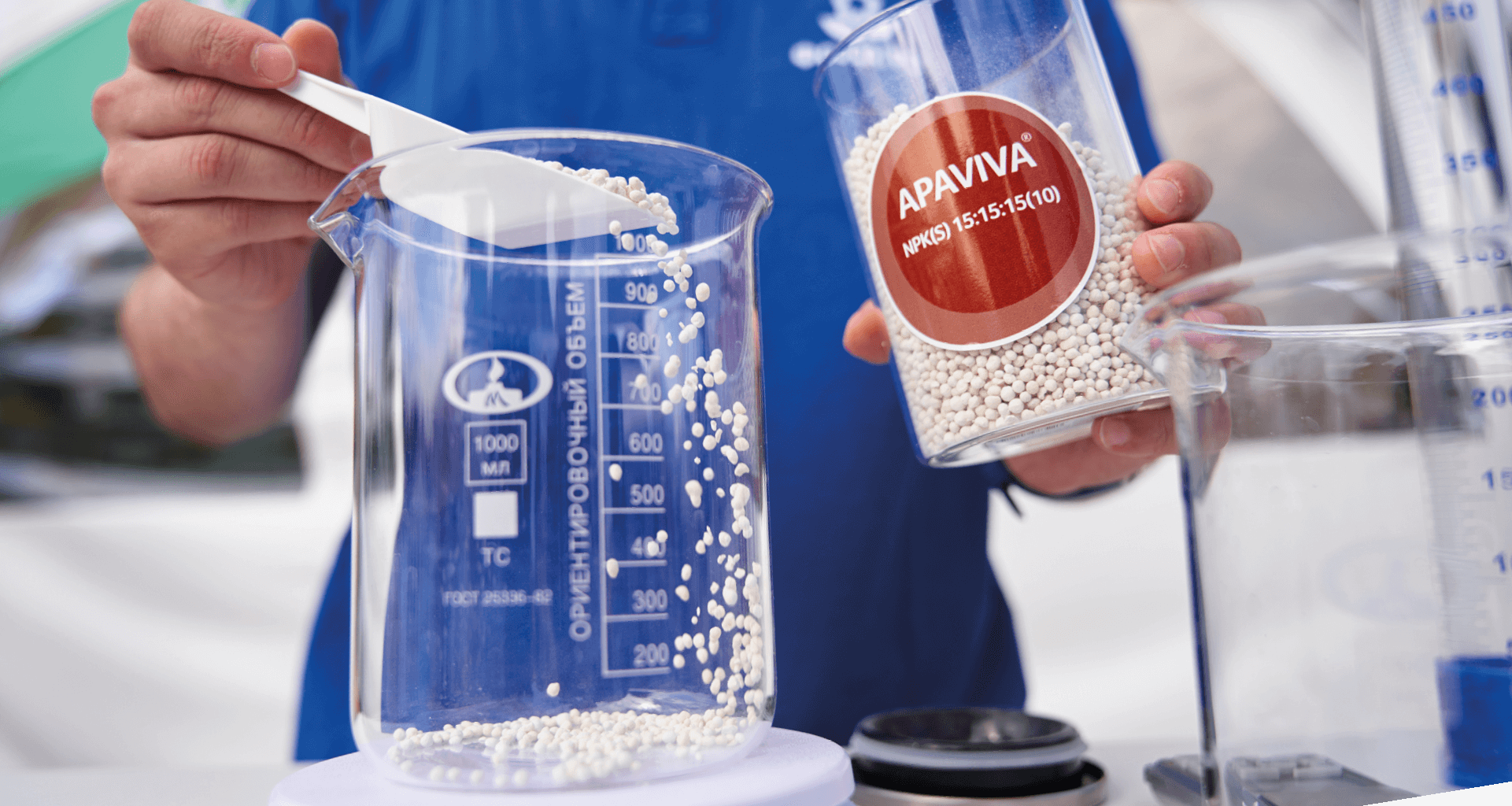

In 2022, our portfolio was expanded to 57 agrochemical grades, including all types of fertilizers and feeds. Two of these grades were registered in 2022. A significant portion of our offering consists of newest fertilizer grades developed over the past five years, including two in the reporting year.

Nitrogen-phosphorus and complex fertilizers

Nitrogen-phosphorus and complex fertilizers with micronutrients

Nitrogen-based fertilizers

Liquid complex fertilizers

Feed grade urea

Feed grade monocalcium phosphate

Sodium tripolyphosphate

- Phosphogypsum for road construction

- Phosphogypsum for farming

- High-grade phosphate rock

- Syenite alkali aluminium concentrate

- Nepheline concentrate

Upstream

Kirovsk Branch of Apatit mines apatite-nepheline ore at six fields of the Khibiny deposits in Russia’s Murmansk region using both underground and open-pit mining methods. PhosAgro Group’s feedstock reserves are of igneous origin, which means that they do not have concentrations of toxic heavy metals. The Company’s phosphate rock is extremely rich in P2O5. The mineral resource base (including off-balance reserves) at one of the world’s richest deposits is expected to last for about 60 years.

The slight y-o-y decrease in balance reserves corresponds to the volume of ore mined.

Currently, the Company is shifting its resource base emphasis from reserves for open-pit mining to a higher share of underground mining reserves. In the reporting year, the share of open-pit mining came in at 78.3%.

In 2022, total apatite-nepheline ore production rose by 3% to 39.51 mt (compared to 38.45 mt in 2021). This increase was due to the commissioning of new capacities at the Kirovsky mine (+10 m level of the Kukisvumchorr deposit) and the Rasvumchorrsky mine (CDU-4).

In 2022, the Company also proceeded with its investment project to develop +10 m level at the Kirovsky mine. The project envisages the construction of two crushing and delivery units for ore drawing, a haulage level and a water drainage, enhancement of the Kirovsky mine’s ventilation system, as well as further level development until 2035.

First start-up facility commissioned

Second start-up facility expected to be launched

Furthermore, the Company proceeded with its Vostochny mine development project seeking to intensify open-pit mining. The investment project focuses on purchases of self-propelled machinery, including dump trucks, excavators and auxiliary machinery, with fleet renewal helping to increase the equipment’s technical availability and utilisation ratios. Additionally, the project involves relocation of infrastructure facilities and expansion of the beneficiation plant's production capacity.

On top of that, we remain committed to the active implementation of our sustainable development strategy. For example, in 2022 the mining and processing plant of Apatit continued sourcing energy generated by the hydroelectric power plants of TGC-1. In the reporting year, green electricity supplies to the plant totalled 300 million kWh. Thus, about 17.8% of the plant’s output is covered by green electricity.

Ore processing

Feedstock

as the key feedstock used in phosphate fertilizers grew by 8.4%

on the back of earlier production unit upgrades and increased equipment utilisation efficiency.

was up by 7.7% year-on-year to

driven by the ramp-up to full capacity of the new unit in Cherepovets and the commissioning and reaching the design capacity of a new unit at the Volkhov site.

also rose by 2.8%

driven by the completion of the capacity expansion project at ammonia production unit No. 3 of the Cherepovets site. This project helped increase daily output to 2,350 t.

Phosphate-based fertilizers

In 2022, the production of phosphate fertilizers and feed phosphates grew by 4.2%

The output of DAP/MAP fertilizers increased by 16.1% to 4.2 mt. The rapid growth rates of DAP/MAP fertilizers was due to the launching and ramp-up to full capacity of MAP production at the Volkhov site, and the higher demand for bicomponent fertilizers in 2022.

NPS production in 2022 surged by 78.6%

Nitrogen-based fertilizers

In 2022, production in the nitrogen segment went up by 5.6%

In 2022, PhosAgro increased total fertilizer sales by 6.8%

Sales of phosphate fertilizers and feed phosphates in 2022 amounted to 8.4 mt, up 8.2% y

In the nitrogen segment, sales were up by 2.3% year-on-year, primarily due to a high seasonal demand and the availability of fertilizers for end users.

In 1Q 2023, the nitrogen-based fertilizer market faced an oversupply as a result of high carry-over stocks (in Europe, North and South America). This continues to pile downward pressure on prices.

The prices of phosphate-based fertilizers have plateaued for now. Higher seasonal activity in South America (primarily in Brazil) in 1Q 2023 coupled with revival in the domestic US market after a significant import drop in 2022 are expected to provide support for the pricing environment.