Strategy

Strategy to 2025

In 2022, PhosAgro continued to make good progress towards the goals of its Strategy to 2025 approved by the Company’s Board of Directors in 2019.

Despite the changing external environment, we consider most objectives of the Strategy to 2025 to be relevant and achievable and continue to implement respective projects and programmes.

Our record-high production of 11.1 mt of mineral fertilizers and other chemical products in the reporting year is an important milestone along this journey.

Sustainability principles are deeply integrated in all of the Strategy to 2025 aspects

- Expansion of the foothold in premium markets

- Higher share of premium fertilizer brands in the sales mix

- Alignment of production and sales

- Reduction of per unit transportation costs

- Developing port infrastructure

- Capacity expansion

- Higher self-sufficiency in feedstock

- Stronger operating efficiency

Capital investments

New promising projects

Despite the changes in the external environment, in 2022 we continued to develop an updated Strategy to 2030, however, this exercise will take us longer than expected due to dramatically increased uncertainty. We continue to greenlight those high-potential projects that offer significant economic and environmental benefits, meet the criteria adopted by the Board of Directors as part of the Strategy to 2025 for the key reviewed scenarios, and aim to promote further development in line with the Company’s strategic priorities – progressive production growth, innovative and ESG-compliant products and processes, and operating efficiency.

Construction of crushing and delivery unit No. 4 (CDU-4) at the Rasvumchorrsky mine (Kirovsk)

2022

Completed successfully. In August 2022, CDU-4 was commissioned at the Rasvumchorrsky mine for ore delivery from underground

ESG agenda

Addressing climate issues, environmental efficiency, energy and resource saving is integral to the Company’s Strategy to 2025. Every addition to our production capacities is designed to employ the best available techniques and operated in strict compliance with the applicable sustainability standards. PhosAgro's framework for assessing promising investment projects is based, among other criteria, on their potential environmental impact. In 2022, we created a methodology for incorporating the carbon price into the system for evaluating the climate impact as a factor in our final investment decisions. This methodology was approved in early 2023. In 2020, the Board of Directors completed the integration of PhosAgro’s climate and environmental agendas into its business strategy by approving Climate and Water strategies that set measurable, achievable targets for reducing the Company's environmental footprint through specific initiatives.

Stable and successful home regions are a key driver of PhosAgro Group's sustainable development. We implement our social investment strategy through promoting efficient and successful cooperation with a broad range of partners. As a reliable long-term partner, we create stable and well-paid jobs for local people, provide good education and place regular orders with local businesses.

Progress

Expansion of the foothold in premium markets

Russia and the CIS

Higher share of premium fertilizer brands in the sales mix

Share of complex fertilizers (NPK/NPS/PKS) in total output

Progress

Capacity expansion

Phosphate rock productionMaintaining high feedstock self-efficiency

AmmoniaStronger operating efficiency

Implementation of organizational development projects in line with the BAT and sustainability criteria

Progress

Reduction of transportation costs

Increased reliance on own rolling stock. Use of innovative railcar fleet

Alignment of production and sales

Rail infrastructure throughput at key production sites:

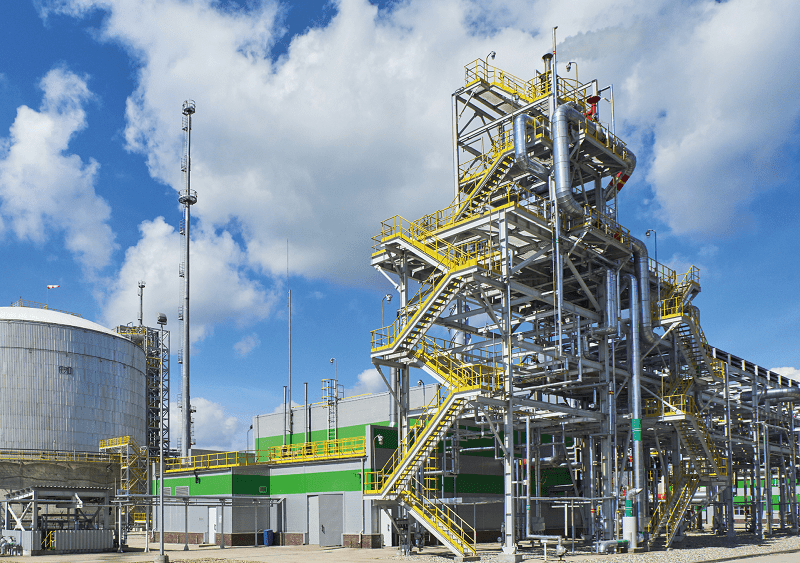

Construction of a heat and power plant in Volkhov

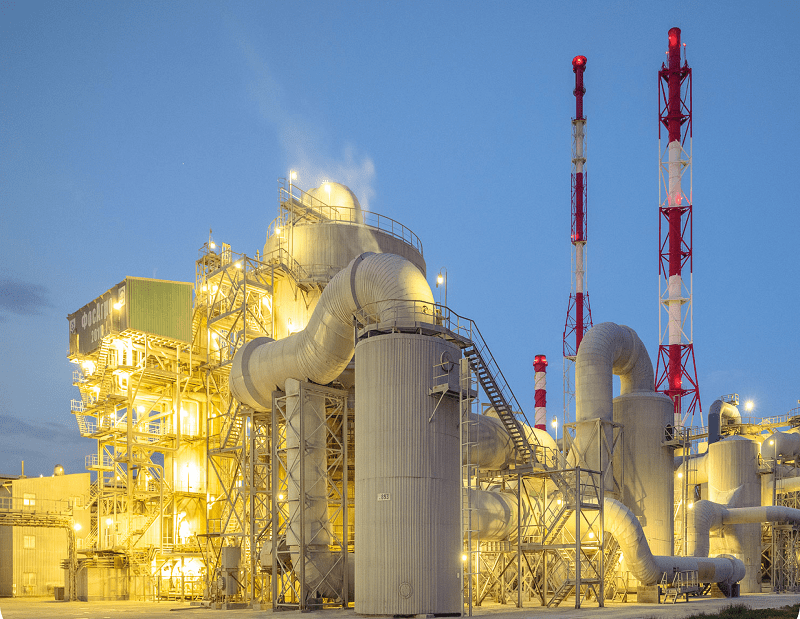

In 2022, the Volkhov branch successfully completed a project to build a new sulphuric acid facility with a heat and power plant. The commissioning of a heat and power plant using process steam from the new sulphuric acid facility will help to reduce both the cost of purchasing electricity from third-party suppliers and greenhouse gas emissions.

The new heat and power plant leverages the most efficient environmental protection technologies and solutions. In particular, it uses cooling towers with a prefabricated metal basin raised above the ground, allowing its integrity to be monitored and preventing hidden water leaks into the ground. The water treatment system relies on a state-of-the-art treatment technology based on reverse osmosis. As part of the HPP project, we also upgraded the site’s storm water collection and treatment system, which now includes an additional treatment unit used to bring the make-up water quality in line with the water circulation cycle requirements. This makes it possible to supply water to the HPP and sulphuric acid production facility while maintaining the closed water circulation cycle of the entire site, eliminating the discharge of waste water into water bodies.

2022

Completed successfully

Promoting and raising awareness about best farming practices and developing the service model

Producing mineral fertilizers with micronutrients which enhance the quality of soils as natural sinks of СO2 and help adapt to climate change

Expanding sales of eco-efficient mineral fertilizers and developing innovative plant nutrition systems

PhosAgro Group is successfully increasing the profitability of its sales by active involvement in the most high-margin markets and through boosting sales of premium mineral fertilizer grades, primarily complex fertilizers.

Expansion of the foothold in premium markets

The strategic flexibility of PhosAgro’s production and logistics capabilities achieved in previous years as a result of a robust investment programme, has enabled the Company to maintain premium margins despite largely diverting its exports to new markets amid restrictions on fertilizer supply from Russia imposed by several countries due to geopolitical reasons. We also remain strongly committed to our home market.

Progress towards our targets

The ongoing expansion of storage and logistics capacities in Russia is in line with our strategy.

From 2018 to 2022, a total of over RUB 3.2 bln was invested in the development of the Russian regional network. In 2022, the number of the network’s distribution centres increased to 33, while the total storage capacity exceeded 800 kt, including 74 kt for the transhipment of liquid mineral fertilizers (a new record for Russia). We also focused on making efficient use of our packaging capacities, with the packaging volume doubling in 2022.

PhosAgro is successfully developing its service model. In 2022, PhosAgro-Region launched commercial service operation of its grain facilities at the distribution centre in Kalach (Voronezh region). At the end of the year, the service revenue from additional services totalled almost RUB 160 mln.

In 2023, the Company plans to focus on further expanding the distribution network, developing existing and launching new logistics centres in key agricultural regions of Russia, enhancing the service offering, and creating a unified system of chemical soil analysis capabilities within its distribution network. To this end, we are building an in-house fleet of vehicles equipped with soil samplers at our distribution centres to enable GPS-based chemical soil analysis.

Higher share of premium fertilizer brands

As the Company forecasted in its 2021 integrated report, demand for dual fertilizer grades continued to prevail in 2022 due to the superior growth of the markets historically focused on these types of fertilizers. The flexibility of our production assets enables us to respond swiftly to changes in the market demand, while maintaining full capacity utilisation.

Following significant changes in the geopolitical and business environment, PhosAgro will revise its strategic sales targets for the share of products sold in premium markets and the share of premium brands in total sales, as part of its updated Strategy to 2030.

Innovative products developed by PhosAgro

Sales of fertilizers introduced over the last five years from 2018 to 2022 exceeded RUB 37.3 bln, or 8% of total sales of the Company’s chemical products. The Company’s ability to maintain a high share of new grades relies on the strong R&D capabilities of NIUIF and PhosAgro Innovation Centre and the flexibility of production capacities achieved through a fundamental overhaul in recent years. All of these give PhosAgro a competitive edge and help the Company meet the growing demand for specific grades that are best suited to certain crops, soils, and farming practices.

Fertilizers with micronutrients

Fertilizers with micronutrients can be accumulated by plants and are considered one of the most potent ways to combat malnutrition and reduce nutrient deficiencies. The Company has maintained a significant share of such fertilizers in its total product mix in recent years and expects it to grow further from 12% in 2022 to 13.6% in 2023.

Biological and biologised mineral fertilizers

PhosAgro Innovation Centre also focuses on developing innovative biostimulants and biologised mineral fertilizers under the Green One label for eco-friendly agricultural products.

With limited soil resources and significant population growth, biotechnology is one of the most effective solutions to ensuring global food security by boosting crop yields without damaging ecosystems.

Coated fertilizers

The Company is developing fertilizers coated with a monocalcium phosphate and dicalcium phosphate mixture and boasting improved environmental and biologicall performance. Research carried out jointly by PhosAgro and the Russian State Agrarian University – Moscow Timiryazev Agricultural Academy proved a significant increase in the uptake of nitrogen and other key nutrients from coated fertilizers, higher grain yields, improved crop quality, and better physical properties of the fertilizers. Unlike polymer coatings developed by other companies, the coatings used by PhosAgro do not lead to the release of microplastics and are therefore not harmful to the environment. Based on the results of our research, in 2022 we received a patent for the invention “A Method to Produce Slow and Controlled-Release Fertilizers”, prepared related publications and presented reports at several international scientific and technical conferences. Two grades of coated fertilizers are now pending registration and the preparatory process to launch their commercial production is underway.

PhosAgro’s digital ecosystem

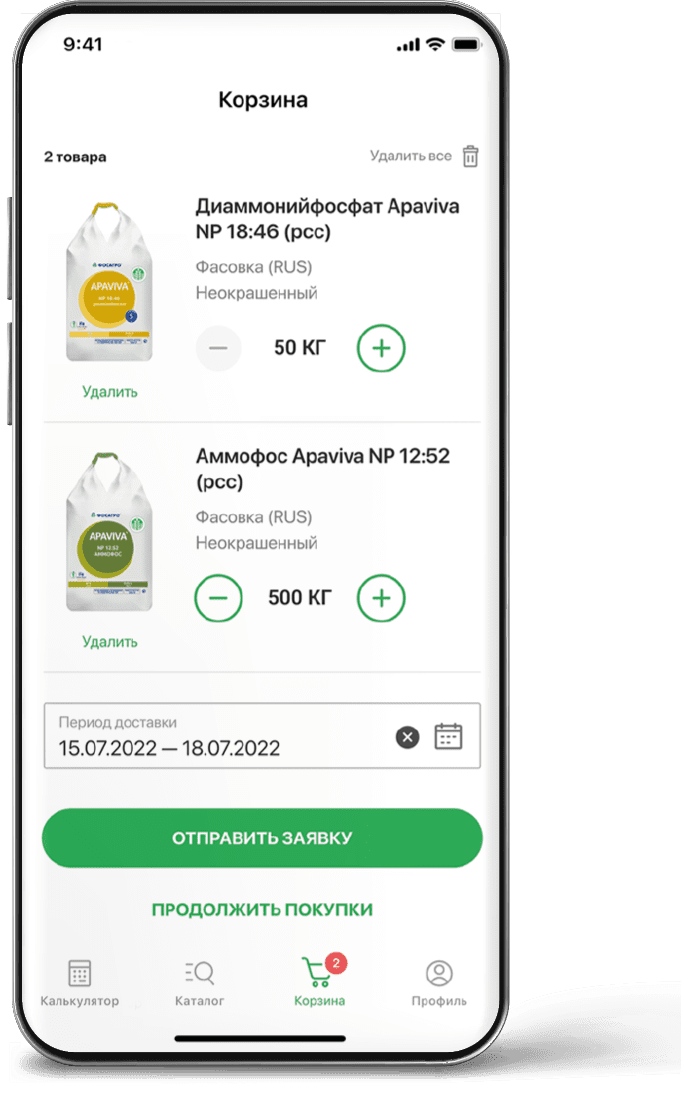

In 2022, the target audience had over 10 million interactions with PhosAgro’s digital ecosystem. As at the end of the year, the number of active users of PhosAgro’s digital services exceeded 47,000, including:

In 2022, the Field Trials section on our website became an important element of communication with our customers in the domestic market. It features 48 trials performed in more than 20 regions of Russia and was visited by some 20,000 users, up tenfold compared to 2021.

We made significant efforts to improve the efficiency of online communication with potential employees. In particular, from January to March 2022, we redesigned the Career section of our website and upgraded its content, adding separate pages for each of the vacancies and launching online promotion.

The following results were achieved as part of the Russia/CIS online trading platform promotion:

To further improve our Agro Calculator, we introduced recommendations in 2022 for seasonal nutrition systems covering sunflower and spring barley, while also completing integration with Cropwise (Syngenta).

In 2022, we launched the full version of the AgroResult mobile app featuring a fertilizer catalogue, a product card, a shopping cart, biometric authentication (face and fingerprint recognition), order history, etc. On top of that, the app was added to the Huawei and Xiaomi app stores.

In 2022, we launched the Pro Agro communication platform, which includes an agronomic YouTube channel, a VK community and a Zen channel.

Over the past year, we released 11 playlists and arranged a number of blogger endorsements.

Managing chemicals and wastes wisely throughout their life cycle, including transportation

Developing rail infrastructure and contributing to the development of local communities through our value chain Enhancing port network, along with offering employment opportunities, developing infrastructure and implementing social investment programmes

Amid the sanctions pressure and artificially imposed restrictions of non-market nature, the key focus of PhosAgro’s logistics operations shifts to ensuring uninterrupted supplies of the Company’s products to consumers in Russia and abroad. This means meeting the set delivery deadlines and preventing the risks of shipping delays and the products being seized or blocked. PhosAgro also seeks to achieve the maximum cost efficiency of its logistics operations in these conditions.

Reduction of transportation costs

Rail transport accounts for the most part of the Company’s domestic shipments (ca. 99%). In 2022, finished products transportation volumes totalled 23.2 mt, up 3% against 2021. Rail shipments are also subject to key measures aimed at improving the reliability of product deliveries and reducing transportation costs. Ensuring a secure supply is a top priority for us.

In 2019–2021, we significantly increased reliance on our own rolling stock, buying mostly innovative railcars with a higher capacity and longer run life. Increased reliance on PhosAgro’s own rolling stock means:

- enhanced safety of operation and more reliable supplies, as PhosAgro’s production and logistics processes are less dependent on third-party services;

- higher cost efficiency, as corporate railcars are cheaper in use than third-party rolling stock;

- positive environmental effect, as the use of innovative rolling stock with higher cargo tonnage per railcar and train reduces the negative impact on the environment per tonne of cargo.

As part of the fleet renewal programme in 2022, we signed contracts for the delivery, in 2023, of 400 mineral hoppers, 65 tank cars and 6,000 specialised containers intended for the use in seaports. Further acquisition of various types of rolling stock in 2023–2027 will be based on a robust analysis of the Company’s actual needs.

Other areas of focus to ensure transportation security and optimise transportation costs in 2022 included:

The share of long trains (more than 56 cars per train) on all transportation routes was 46% in 2022, up 4 p.p. compared to 2021. Further potential in this area is associated with the transition to 100-car trains, which will help boost economic efficiency and safety of the Company’s shipments, while also further reducing the environmental impact per tonne of cargo.

Alignment of production and sales

Rail infrastructure throughput capacity at the Company’s fertilizer hubs is critical to efficient transportation. Thanks to our investment programmes, we have been able to expand throughput capacity to or above target levels over the last three years.

As the Kryolite station has come on stream, long trains (71 railcars and longer vs the standard 56) now run along the Apatity–Cherepovets–Ust-Luga–Apatity loop. With this loop, created under an ambitious joint project with Russian Railways, long trains accounted for ca. 73% of PhosAgro Group’s 2022 transportation volumes along this route. The decision to electrify the Kryolite railway station enabled PhosAgro to stop using diesel locomotives, thus securing positive economic and environmental effects.

In 2022, due to an upgrade in Balakovo we continued planning the development of infrastructure that would facilitate shipments of a new feedstock and allow for increased transportation of finished products. It is planned that the throughput capacity of the Balakovo site’s railway infrastructure will increase from the current 6.7 mtpa to 9 mtpa by 2025, which exceeds the target set in the Strategy to 2025.

In 2022, the rail infrastructure throughput capacity at the Volkhov site was ramped up to 3.8 mtpa from 2.64 mtpa as at the end of 2021. The project is on schedule, with the first stage already completed. We have reached an agreement with Russian Railways to co-finance the construction of public infrastructure as part of the second stage.

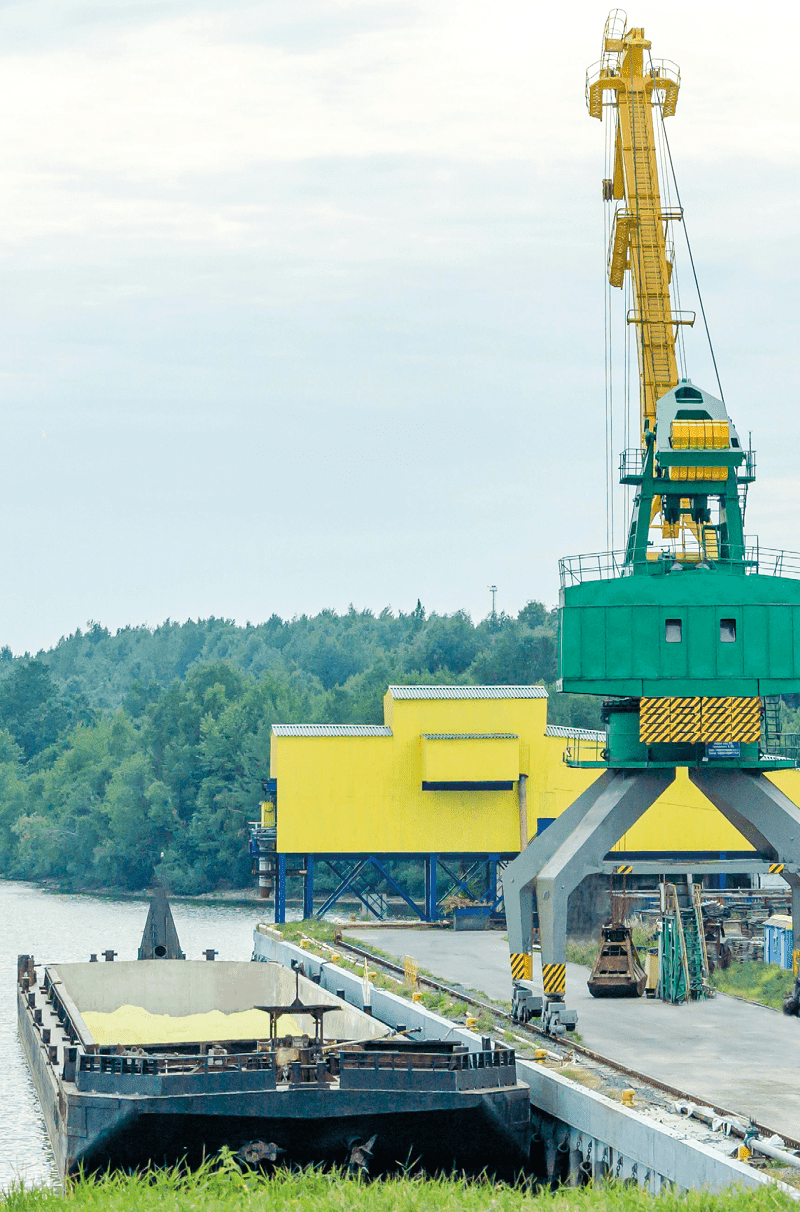

Developing port infrastructure

In addition to developing logistics and sales infrastructure across Russia, our priority market, we are working to increase the reliability and efficiency of our exports by both reducing transportation costs and providing state-of-the-art transhipment capacities.

Our strategic aim is to develop and maintain a balanced port sales infrastructure in terms of costs and reliability, capable of handling at least 8 mtpa of fertilizer exports. To achieve this target, in 2022 the Company revised a number of transhipment contracts covering the required export volumes and effective through 2025. As of today, we have basically secured the required transhipment capacities in line with the 8 mtpa target.

The ports key to PhosAgro’s operations are located in the North-West of Russia. These include European Sulphur Terminal and Petrolesport in the Leningrad region and St Petersburg, and Murmansk Bulk Terminal in Murmansk. The Company also uses a terminal in Kotka, Finland. We rely on specialised terminals and their equipment designed to mitigate the environmental impact.

Capacity expansion

Making eco-efficient products in line with sustainability requirements and maximising the use of production waste in further processes

Maintaining and developing existing operations and creating innovative facilities

Progress towards our targets

Despite short-term volatility concerns, mineral fertilizer demand is set to demonstrate solid growth in the long term.

In order to respond to stronger demand, PhosAgro focuses on expanding capacities to produce its key products.

Higher self-sufficiency in feedstock

Strong vertical integration is PhosAgro’s major competitive advantage. With our phosphate rock reserves covering 100% of the Company’s needs for raw materials required for phosphate mineral fertilizers, we are ramping up the production of other key commodities, thus increasing our self-efficiency in feedstock.

Implementation of high-priority projects

Development of the Volkhov branch of Apatit (phase 3 – construction of a unit to produce water soluble MAP)

2023

Phase 3 (construction of a water soluble MAP facility) start-up operations commenced in December 2022, with the first product batch received in January 2023.

Increase in output of feed-grade monocalcium phosphate (MCP) by 53 ktpa (Balakovo)

2023

Upgrade of wet-process phosphoric acid unit No. 4 (WPA-4) was completed. Work to upgrade the mineral salts unit (MSU) is in progress.

Capacity ramp-up of the Am-3 unit to 107% (Cherepovets)

2022

In May 2022, the target capacity of 2,350 t/day was achieved. In 3Q 2022, the entire set of works was completed.

Upgrade of the SK-20 sulphuric acid technological system with replacement of the contact process unit (Balakovo)

2023

Contracts for the supply of main process equipment were signed; construction and installation work is underway and slated for completion in 4Q 2023.

Operating efficiency improvements

At PhosAgro, we are implementing a whole range of projects and initiatives to improve our technologies and organisational approaches and streamline production processes.

In 2022, three projects were successfully implemented by the Company to improve the performance of Apatit’s business units. They covered all of the PhosAgro’s production sites and produced an overall economic effect of ca. RUB 1. 8 bln in the reporting year.

2021–2022

- Increasing phosphoric acid output by reducing unscheduled shutdowns

- Reducing end-to-end phosphate rock losses

- Ensuring stringent compliance with preventive maintenance schedules at ANBP-2 and ANBP-3

2021–2022

- Introducing production culture monitoring across all business units

- Reducing scheduled preventive maintenance hours by an average of 20%

- Implementing tools aimed at improving operational efficiency: punchlists, problem-solving boards, equipment checklists, etc.